As someone who’s turned the world into my office, I’ve learned that the secret to perpetual adventure isn’t just to save. In fact, the most important work is investing in knowledge.

And in this article, I’m going to give you everything you need to know when selecting a travel savings app.

Soooo, let’s get down to the nitty-gritty – you’ve got the flights booked (high five!), and now you’re diving into the fun part. But wait! Before you zip that suitcase, let’s chat about something crucial – the best travel savings apps.

After a decade of zipping from time zones to zip codes, trust me, these little digital gems are what you’ll want to thank your past self for. Juuuuuust as much as that neck pillow and noise-canceling headphones.

Don’t think about it as pinching pennies; those saved dollars are just epic memories waiting to happen.

Ready to make your bank account as passport-stamped as you are? Let’s jet-set into this savvy saver’s guide.

Vacation Saving Apps: Best Apps to Save Money for Vacation

Let’s talk about saving up for that ‘oh-so-needed‘ vacation. We’re not just dreaming of margaritas and sunsets; we’re making it happen, penny by penny. After all, who doesn’t want a little extra cash for that unplanned detour to a hidden beach or a spontaneous street food feast?

Acorns

Description:

- Acorns is a micro-investing app that rounds up your daily purchases to the nearest dollar and invests the change into a diversified portfolio.

- Acorns is perfect for beginners due to its simple, hands-off investment strategy. It’s also suitable for intermediate users who might take advantage of its additional features, like bonus investments from partners and educational content.

Features:

- Round-up investments from everyday purchases

- Automated recurring contributions

- Earn bonus investments from Acorns partners

- Educational content to boost your financial knowledge

Best For:

Travelers who want to save money without thinking about it and are interested in growing their travel funds through investments.

PROS

- Effortless way to save and invest spare change

- User-friendly interface suitable for beginners

- Offers a cash-back feature when you shop with partner brands

CONS

- Monthly fee that might not be cost-effective for small balances

- Limited control over individual investment choices

YNAB (You Need A Budget)

Description:

- YNAB is a budgeting app designed to help you gain total control of your money, with a strong focus on planning your spending and saving.

- YNAB requires a more hands-on approach and is great for users who want to get deeply involved with their budgeting. It’s more suited to intermediate users who are comfortable with budgeting basics, and advanced users will appreciate the detailed reports and goal-tracking capabilities.

Features:

- Personalized budgeting categories

- Bank syncing and transaction matching

- Real-time access to all your budgeting data

- Debt paydown and goal tracking tools

Best For:

Travelers who are serious about budgeting every dollar and want a tool that helps with planning and saving for trips in a disciplined way.

PROS

- Encourages proactive budgeting and saving for specific goals

- Detailed reports and forecasting

- Active community and educational resources

CONS

- Steeper learning curve for budgeting novices

- Requires a monthly or annual subscription after the free trial

Oportun, formerly known as Digit

Description:

- Oportun analyzes your spending habits and automatically transfers small amounts of money from your checking account to a Digit savings account.

- Ideal for beginners because it takes the guesswork out of saving. Its automated saving feature is excellent for those who don’t want to actively manage their savings. However, it lacks the advanced features that more serious savers or investors might look for.

Features:

- Automated savings based on your spending habits

- Low balance protection to avoid overdrafts

- Savings bonuses for staying with the service

- Ability to set specific financial goals

Best For:

Those who struggle to save and would benefit from an automated system that does it for them, making it a great option for stashing away funds for less immediate travel plans.

PROS

- Hands-off approach to saving money

- Savings bonuses every three months

- Easy to use with a straightforward interface

CONS

- Monthly fee after a free trial period

- Savings don’t earn interest

Revolut

Description:

- Revolut is a digital banking app that offers a range of money management features, including savings vaults where you can stash your money for specific goals, like your upcoming travels.

- Intermediate – Offers more than just saving functions, including budgeting and currency exchange, which might require some financial know-how to navigate effectively, especially for international travelers.

Features:

- Savings Vaults for setting aside funds

- Budgeting and analytics to monitor spending

- Currency exchange with no hidden fees

- Earn interest on savings with a Premium account

Best For:

Global travelers that are looking for a comprehensive money management tool with the added ability to save and spend in multiple currencies.

PROS

- Multiple currency support is ideal for international travelers

- Flexible saving with the ability to set up one-time or recurring transfers

- Savings Vaults can be individual or group-based for shared travel goals

CONS

- The basic account has limited earning interest on savings

- Some advanced features require a Premium subscription

Monese

Description:

- Monese is a mobile-only bank that provides a simple way to manage and save money with features designed for those on the go, making it useful for saving towards travel.

- Intermediate – While it’s user-friendly, Monese is best for those who have some experience with digital banking and are comfortable managing accounts via a mobile app.

Features:

- Easy-to-create Pots for separating your savings from your spending money

- Instant account opening with no credit checks

- Real-time transaction notifications

- Budgeting tools to help keep your travel spending on track

Best For:

Individuals and digital nomads who want a straightforward banking experience with easy saving tools for managing travel funds.

PROS

- No fixed monthly fees on basic plans

- Quick setup of designated savings pots

- Access to budgeting features helps with saving discipline

CONS

- No interest earned on savings in the basic plan

- Currency exchange services may include fees

Apps for Saving Money for a Trip. What are they? Why Use Them?

Why use them? Because who doesn’t love automating the boring bits and focusing on the thrill of planning those snorkeling escapades or that food tour in Paris? Or forking out a little more for your flight

These apps are the silent budget ninjas – think rounding up transactions, finding sneaky savings you didn’t know about, or just giving you the brutal (but necessary) truth about your spending habits. And when you’re finally sipping that pina colada on a sun-lounger, you’ll know it was those apps that helped you get there, financially speaking.

But hey, while we’re talking about making travel easier, have you checked out our Solo Travel eBook? It’s packed with tips to make your solo adventures epic and wallet-friendly. And for those who have embraced the digital nomad lifestyle, don’t miss our Rebel Nomad Playbook—your guide to living freely and working remotely. Both are perfect companions to your travel saving apps, ensuring you’re armed with knowledge and resources to make the most of your journeys.

How to Choose a Vacation Fund App

Think of choosing a vacation fund app like selecting the perfect travel buddy—compatibility is key. You want an app that gets your savings style and matches your financial journey, whether that’s slow and steady saving or aggressive investing.

Start by asking, “What’s my savings goal?” and “How hands-on do I want to be?” If you love details and have specific travel goals, an app with robust budgeting features might be your ticket. Or, if you prefer a ‘set it and forget it’ approach, look for an app that automagically squirrels away your spare change. Don’t forget to check out fees, user reviews, and the security of the app—after all, this is your hard-earned cash we’re talking about.

Consider examples like these popular choices:

Qapital

Qapital lets you set specific savings goals and rules for when to transfer money. For instance, you can create a rule to round up every purchase to the nearest dollar and save the change. If you spend about $1,500 monthly with your debit card, the round-ups could easily add up to around $50 a month—meaning an extra $600 a year towards your Bali trip!

Stash

Stash is an investing app that allows you to start with as little as $5. If you choose to invest in one of their moderate portfolios and contribute $100 monthly, you might see an average of 5% annual return (remember, the market can always fluctuate). Over five years, you could potentially save $6,500, depending on market conditions, giving you a decent budget for a dream European tour.

Chime

Chime rounds up transactions to the nearest dollar and transfers the difference into savings. Plus, they offer a 0.50% APY on savings. If you’re a frequent shopper, those round-ups could add up significantly. Say your monthly expenses round up to $75; in a year, that’s $900, not including the interest earned, which can cover a round trip to Japan!

Fyi, these are just illustrative examples, and actual savings will vary based on individual spending habits and the rules you set within the apps. But, I wanted to give you a sense of the potential with these savings apps, and how much you can possibly save! Sure, returns on investments with apps like Stash are never guaranteed. But one thing’s for sure—using these apps can make the daunting task of saving money more manageable.

Are You Ready to Pick an App to Save for Vacation?

Time for some real talk. Selecting the right savings app is a personal choice, and I’ve been down this road. What I look for is simple: effectiveness, ease, and a bit of fun. Do you need an app that nudges you to save more? Or one that turns spare change into travel funds?

I’ve tried a bunch, from apps that round up change to those that invest it. The truth? It’s all about what fits your habits. For me, seeing an extra $30 at the end of the month from rounded-up coffee purchases is a small victory towards my next dive in the Great Barrier Reef. Yes… I drink A LOT of coffee…

So, what’s it going to be for you?

Trip Tracker Apps

Getting ready for your next adventure involves more than just saving money; it’s also about managing your itinerary effectively. This is where trip tracker apps come into play, something I’ve found indispensable on my travels.

These apps track your flights, hotel bookings, and activities, often in real-time. For instance, using an app like TripIt has saved me from missing flights or double-booking accommodations more times than I can count. The potential savings in avoiding change fees or last-minute bookings is as valuable as any dollar amount—especially when you’re on a tight travel budget.

When choosing a trip tracker app, go for one that syncs easily with your email and calendar, aggregates all your travel information in one place, and updates you with timely notifications. The right app won’t just keep your finances in line; it’ll keep your entire trip on track.

As you’re piecing together your next getaway, be sure to explore our curated list of Destinations for hidden gems and popular hotspots. If you’re planning to stay connected without the hassle of physical SIM cards, our guide to the best eSIMs for travelers will be a game-changer. And for everything else, from packing lists to local customs, dive into our comprehensive Resources page to ensure you’re fully prepared for what lies ahead.

#1 Travel Diary App: Day One Journal

Day One Journal stands out with its sleek interface and the ability to include photos, maps, and tags to document every aspect of your trips. The app’s privacy features and syncing capabilities make it an ideal travel companion for iPhone users who like to reflect and record their travel experiences in detail.

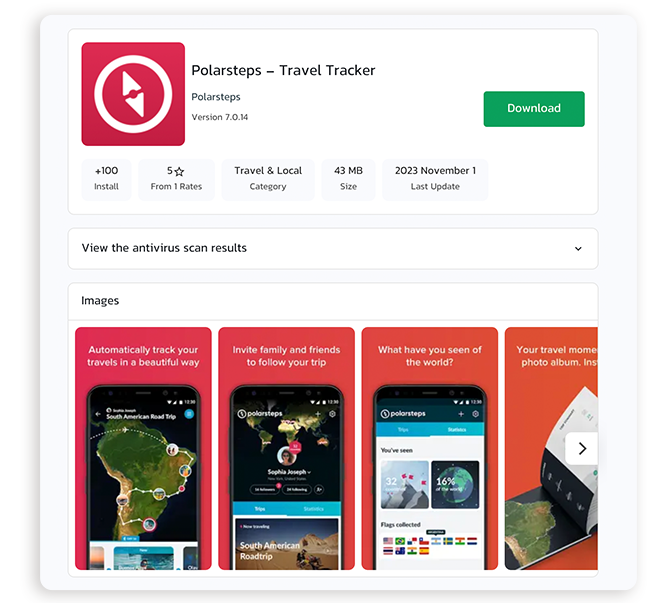

#1 App to Track Travel on Map: Polarsteps

Polarsteps automatically tracks your route and places you’ve visited. You can create a beautiful travelog that combines your travel routes, locations, and photos in one place, making it easy to share and look back on your adventures.

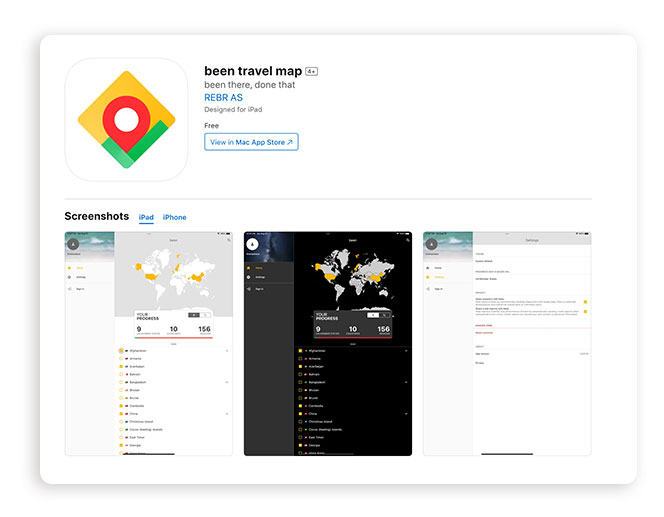

#1 App to Track Countries Visited: Been

Been is a straightforward app designed to help you keep track of the countries and states you’ve visited. Its simple interface allows you to quickly mark off places on the map, giving you a visual representation of your travels.

Best Travel Journal App for iPhone: Momento

Momento is perfect for iPhone users, offering smart features that pull in data from social media platforms to create a rich, multimedia diary entry for each day of your travels.

Best Last Minute Flights Apps: Hopper

Hopper uses predictive analytics to suggest when you should book your flights, potentially saving you money by advising you on the best times to purchase last-minute flights. It’s a game-changer for both iOS and Android users looking for the best travel deals.

#1 Digital Travel Journal: Journey

Journey offers a robust platform that’s compatible across multiple devices. It’s great for travelers who want to document their journey digitally with the added benefit of cloud storage, ensuring your memories are safe.

Essential Amazon Products for Savvy Travel Savers

Discover must-have Amazon products that smart travelers swear by to save money and streamline their journeys, from a sleek, space-saving portable luggage scale to an indispensable power bank for on-the-go charging.

Etekcity Digital Hanging Luggage Scale

The luggage scale has a lightweight and compact design, Easy-to-read digital display, Max capacity of up to 110 pounds

Zoppen Multi-purpose Rfid Blocking Travel Passport Wallet

RFID-blocking technology of this travel passport is for security, Dedicated slots for passport, cards, and cash, A variety of colors to choose from

Brita Premium Filtering Water Bottle

This water bottle has a durable stainless steel with a replaceable filter, Reduces chlorine taste and odor in tap water, Insulated to keep water cold

Anker PowerCore 10000 Portable Charger

One of the smallest and lightest 10000mAh power banks, High-speed charging technology, Compatible with most smartphones and tablets